lhdn benefit in kind 2017

These non-monetary benefits are considered as income to the employees. Here are some of the benefits in kind you may receive as an employee.

BIK refers to benefits given to employees which cannot be convertible into money such as motorcar and household furnishings apparatus and appliances.

. Under the circumstances where no rent is paid for the living accommodation the defined value is the rateable value as determined by the local rating authority for purposes of payment of assessment rates LEMBAGA HASIL DALAM NEGERI MALAYSIA. Bik item descriptions if any will show. Under this method each benefit provided to the employee is ascertained by using the formula below.

22004 issued on 8 November 2004. What is Benefit In Kind BIK. The most common type of Benefit In Kind are.

There are no further changes to the lump-sum valuation method for the benefit in kind. B any appointment or office whether public or not and whether or not that relationship subsists for which remuneration is payable. A employment in which the relationship of master and servant subsists.

This means that these benefits cannot be converted to cash when they are given to the employee. Therefore the value of living accommodation benefit received by Puan Bee for YA 2005 is RM12000. Benefit In Kind is a non-cash allowance.

33 per month after EPF deductions Above RM3820225 per year before EPF deductions or RM318352 per month before EPF deductions While taking all benefits allowances bonuses overtime and commissions into consideration then the answer is yes. 112019 12122019 - Refer Year 2019. Lembaga Hasil Dalam Negeri Malaysia.

BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia. Where a motorcar is provided the benefit to be assessed is the.

You will notice that the final figures on that table are in bold. A car for company purposes home phones with personal use private health insurance non-business travel expenses approved profit-sharing schemes staff meals provided at the place of employment business expenses that were paid for on a company credit card. Motorcar and other related benefits 711.

According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year. Benefit in kind lhdn. BIK are non-monetary benefits.

Superceded by Public Ruling No122017 29122017 - Refer Year 2017. Deduction Claim 24 13. Mtd is deducted in accordance with the income tax deduction from remuneration rules 1994 and included benefit in kindbik and value of.

It is worth noting that the discussion on the imposition of zakat. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the. Superceded by the Public Ruling No.

New registration of motor vehicle by type Malaysia 2017 and 2018 Appendix 1. A further clarification on benefits-in-kind in the form of goods and services offered at discounted prices. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

These benefits-in-kind are mentioned in paragraphs 43 and 44 of the Public Ruling No. ULUM ISLAMIYYAH VOL. 86 g CO2km instead of 87 g CO2km for income year 2017.

This benefit is treated as income of the employees. Particular Benefit In Kind 71. If you didnt earn that much last year you probably dont need to worry about that.

2012 return form of employer form lembaga hasil dalam negeri malaysia e this. 22 However there are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable. 22 DECEMBER 2017 Pp 1-8 ISSN 1675 5936 E-ISSN 2289 - 4799 wwwuijournalusimedumy Manuscript received date.

Above RM34000 per year after EPF deductions or RM2833. Benefit in kind lhdn Jom Join Team Pink Lady Kami Komisyen Lumayan Tidak Perlu Modal Bahan Bahan Iklan Disediakan Mudah Naik Level Group Whatsa Dropshippers Shopping Certified Original Stamp Illustration Postage Stamp Certified Stamp Transpar Instagram Logo Transparent Overlays Transparent Overlays Transparent Background. 2017 budget speech finance bill 2016.

Kind received by an employee are taxable by Inland Revenue Board of Malaysia LHDN except for benefits listed in Paragraph 9. Thats because the rates for people who earn on that last two higher brackets have been increased from 25 to 26 and 25 to 28. Employee Benefits An individual under employment may be provided employee benefits by his employer.

The Wiky Legal Encyclopedia covers legislation case law regulations and doctrine in the United States Europe Asia South America Africa UK Australia and around the world including international law and comparative law.

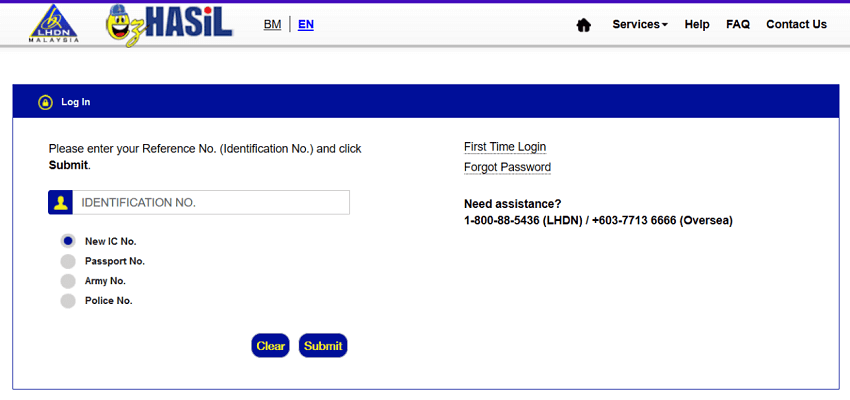

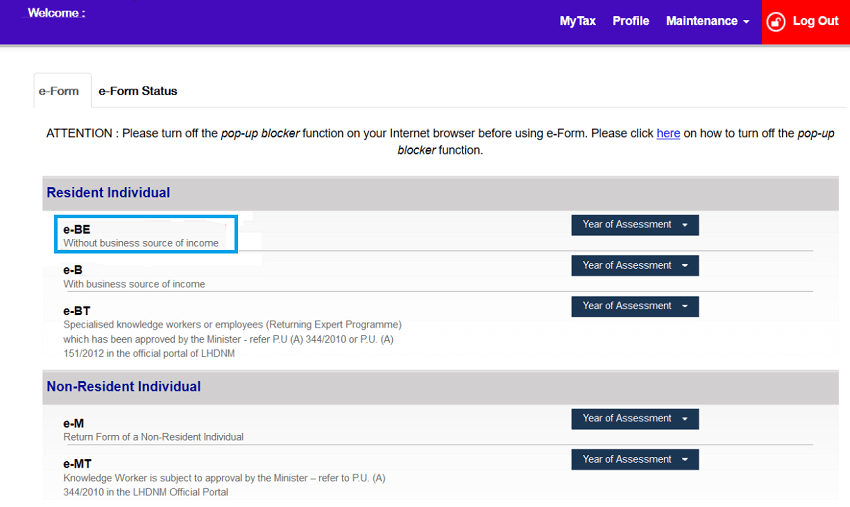

Ctos Lhdn E Filing Guide For Clueless Employees

Public Ruling Benefit In Kind Warning Tt Undefined Function 32 Inland Revenue Board Of Studocu

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Lhdn Irb Personal Income Tax Relief 2020

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Understanding Lhdn Form Ea Form E And Form Cp8d

Employer S Tax Reporting Subang Pages 51 100 Flip Pdf Download Fliphtml5

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Malaysia Personal Income Tax Relief 2021

Understanding Lhdn Form Ea Form E And Form Cp8d

Malaysia Personal Income Tax Relief 2022

Ctos Lhdn E Filing Guide For Clueless Employees

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

No comments for "lhdn benefit in kind 2017"

Post a Comment